Retirement should be your golden years—a time to relax, enjoy hobbies, and spend quality time with family. But for millions of American seniors, financial stress is making these years anything but golden. If you’re struggling to make ends meet on a fixed income, you’re not alone, and more importantly, there are proven strategies that can help you take control of your finances.

Table of Contents

The Real Financial Challenges Seniors Face Today

Living on Fixed Income While Costs Keep Rising

The harsh reality is that 80% of Americans 60 and older are either financially struggling now or are at risk for economic insecurity in retirement . With the average Social Security payment providing less than half of average wages, many seniors find themselves caught between rising costs and unchanging income.

“The average monthly Social Security check was $1,847 at the end of 2023,” yet basic living expenses for a senior in excellent health can require $3,665 per month just to cover necessities. This gap forces difficult decisions between paying for medicine, food, or utilities.

Healthcare Costs Eating Up Your Budget

Healthcare expenses represent one of the most unpredictable financial challenges for seniors. The average annual healthcare cost for seniors surpasses $19,000, accounting for approximately 17% of their monthly income. A healthy 65-year-old male retiring in 2024 is projected to spend approximately $281,000 on healthcare expenses during his retirement.

Housing Costs Consuming Too Much Income

Housing remains the largest expense category for retirees, averaging $21,445 annually and accounting for over 36% of annual expenditures. Nearly 17 percent of people over age 50 are moderately burdened, spending from 30 percent to 50 percent of their income on housing, while another 16 percent spend more than half of their income on housing.

Rising Credit Card Debt Among Seniors

A disturbing trend shows that 68% of retirees had outstanding credit card debt in 2024, up substantially from 40% in 2022. Among households headed by someone between ages 65-74, 41% carry credit card debt, with median amounts topping $2,850.

Genius Budgeting Solutions That Actually Work

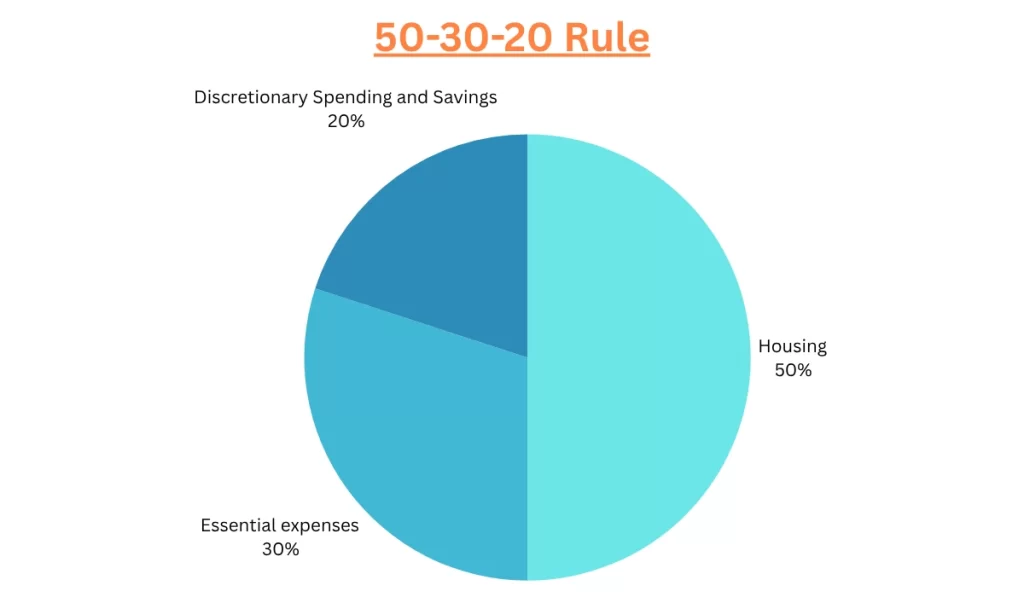

Start With the 50/30/20 Rule for Seniors

Eleanor Clark, a 65-year-old retired therapist, successfully manages her retirement budget using a modified approach. “I’ve tracked my income and spending in the same spreadsheet for years,” said Clark. “Having these numbers helped me identify costs that stayed the same versus ones that changed every month”.

Her monthly budget breakdown shows how to allocate a $4,000 monthly income:

- Housing: $1,800 (45%)

- Essential expenses (utilities, phone, groceries, healthcare): $1,200 (30%)

- Discretionary spending and savings: $1,000 (25%)

Master the Art of Grocery Budget Management

The average monthly grocery bill for a single person can be between $165 and $345. According to the USDA Low-Cost Food Plan, older adults age 51–70 should budget $65.80 weekly for men and $59.20 for women.

Smart grocery strategies

- Make a detailed shopping list and stick to it

- Prepare meals yourself instead of buying pre-packaged foods

- Shop sales at different stores to maximize savings

- Use senior discount days at grocery stores

Take Advantage of Government Assistance Programs

Many seniors don’t realize they qualify for assistance programs that can significantly reduce their expenses. The Supplemental Nutrition Assistance Program (SNAP) offers support for food-insecure seniors, with approximately 4.8 million seniors currently receiving benefits.

For 2025, seniors can qualify if their monthly income is under $15,060 for one person or $20,440 for two people. Importantly, seniors aged 60 and older only need to meet the net income test, making qualification easier than for younger adults.

Slash Your Energy Bills

The Low-Income Home Energy Assistance Program (LIHEAP) provides federally funded grants to help qualified seniors with heating and cooling costs. Ohio’s Percentage of Income Payment Plan (PIPP) requires qualified low-income customers to pay only 6% of their monthly income for gas and electric service.

Maximize Healthcare Savings

The Medicare Extra Help Program can save qualifying seniors approximately $5,300 annually on prescription drug coverage. This program eliminates the Medicare Part D “donut hole” and removes late enrollment penalties.

Susan, a 73-year-old retiree, shares: “Retirement can sometimes be a guessing game, but having this budget is such a relief”. She discovered that by working part-time at The Container Store just three days a week, she could add an extra $1,000 to her monthly income while enjoying the social interaction.

Smart Transportation Solutions

The average retiree spends 12% of their monthly budget on transportation. Seniors can save significantly by:

- Using public transportation with senior discounts (20-40% off regular fares)

- Taking advantage of Amtrak’s 10% discount for riders 65 and up

- Utilizing local senior transportation programs that offer door-to-door service

According to transportation expert Mike O’Neill, “Senior-specific transportation programs are prevalent in many cities and towns across the country, with fares typically lowered by 20% to 40% compared to standard prices”.

Build an Emergency Fund on Fixed Income

Financial experts recommend that retirees maintain emergency funds covering six months to a year of expenses. Start small if necessary—even $25 per month can build meaningful savings over time.

Mark and Cyndie, a South Florida couple now in their 70s, successfully built their retirement security by “setting aside as much of their income as possible in tax-deferred savings plans”. Cyndie explained: “We like to spend what we have, so it was better to take the savings out before we saw it, and we made it work from there”.

Real-World Success Stories: Seniors Who Made It Work

Jennifer’s Budget Transformation

Jennifer S., a Women United program participant, shares: “I always thought I was good at budgeting, but they gave me so many tools to help me become better at managing my money”. “Now about every 6 months I sit down with a budgeting worksheet and look to see if anything has changed, and I set new goals for myself”.

Dana’s Savings Success

Dana, another program graduate, reports: “Since I started with Women United, I always keep track of my spending and budget every month. I actually have money in a savings account now”. She emphasizes how transportation assistance and childcare support made it possible for her to attend financial workshops.

Angela’s Credit Recovery

Angela and her family of six were “living paycheck to paycheck” before discovering YNAB budgeting 14. After implementing their system, “They paid off their credit cards and kept them paid off. Bills came due and they just paid them”. Her previously “very poor” credit score became “near perfect”.

Essential Budgeting Tools for Seniors

Technology That Simplifies Money Management

YNAB (You Need A Budget) encourages proactive budgeting with a user-friendly interface designed for clear, straightforward financial management. EveryDollar promotes zero-based budgeting where every dollar is allocated at the beginning of the month.

PocketGuard simplifies budget management by showing exactly how much money is available for spending after bills and goals are accounted for. Free online budget planners help seniors track income and expenses while suggesting ways to improve finances.

The Envelope Method for Fixed Incomes

Many successful seniors use a modern version of the traditional envelope budgeting system. As one budgeting expert noted: “It was like the envelope system, but now the envelopes were virtual!”

Also Read: Purpose after Retirement: A Guide for U.S. Seniors to Rediscover Meaning and Joy

Frequently Asked Questions

How much should a senior spend on groceries per month?

According to the USDA Low-Cost Food Plan, seniors should budget approximately $260-280 monthly for groceries 2021. The average monthly grocery cost for one person ranges from $239 to $529, depending on dietary preferences and shopping habits.

What percentage of income should seniors spend on housing?

Financial experts recommend that seniors spend no more than 30% of their income on housing costs. However, nearly 33% of Americans over age 50 currently carry a moderate to severe housing cost burden, spending 30-50% or more of their income on housing.

How can seniors reduce healthcare costs on a fixed income?

Seniors can reduce healthcare costs by enrolling in Medicare Extra Help, which saves approximately $5,300 annually. Medicare Savings Programs help with premiums and cost-sharing expenses, and there are no resource tests for these programs. Prescription discount programs like AARP’s can save an average of 61% on FDA-approved drugs.

What government programs help seniors with monthly bills?

Key programs include SNAP for food assistance (qualifying if monthly income is under $15,060 for one person), LIHEAP for energy bill assistance, and Medicare Extra Help for prescription drug costs. The Senior Nutrition Program delivers over 251 million meals annually to seniors nationwide.

How much should seniors have in emergency savings?

Financial experts recommend that retirees maintain emergency funds covering six months to a year of expenses. However, seniors can start small and build gradually, as any emergency fund is better than none when living on fixed income.

Can seniors work part-time to supplement their budget?

Yes, many seniors successfully supplement their income with part-time work. Susan, age 73, worked three days a week at The Container Store to add $1,000 monthly to her budget while enjoying social interaction. Social Security recipients should understand how earnings may affect their benefits.

What’s the best way for seniors to track their spending?

Successful seniors recommend using simple spreadsheets to track income and expenses monthly. Budgeting apps like YNAB, EveryDollar, and PocketGuard offer senior-friendly interfaces for digital tracking. The key is choosing a method you’ll actually use consistently.

How can seniors avoid credit card debt in retirement?

Experts recommend using debit cards instead of credit cards to prevent accumulating new debt. If carrying credit card debt, contact issuers about hardship programs that offer reduced interest rates and waived fees. Focus on paying off balances before they become unmanageable on fixed income.

Remember, successful budgeting in retirement isn’t about living in poverty—it’s about making informed choices that allow you to enjoy your golden years without financial stress. As one financial expert wisely noted: “When you understand that your self-worth is not determined by your net-worth, then you’ll have financial freedom”.

Start with one or two strategies from this guide, and gradually build your confidence and skills. Your future self will thank you for taking control of your finances today.